The Government of Punjab has officially launched the first-of-its-kind, multi-million-rupee scheme to support entrepreneurs and small businesses. The Asaan Karobar Finance Scheme 2025 aims to provide interest-free loans with minimal conditions, making it easier for startups across various sectors, including agriculture, to grow. With a strong focus on economic development, this initiative is designed to boost exports, create jobs, and help businesses overcome financial constraints. The Punjab government has allocated a significant budget for this program, ensuring that businesses receive the necessary financial assistance to thrive.

The Punjab Karobar Finance Scheme was formally approved during the 22nd Provincial Cabinet Meeting on Tuesday, January 14, 2025, under the leadership of CM Punjab Maryam Nawaz Sharif. A key highlight of this meeting was the provision of free land for eligible start-ups, along with a target of establishing 100,000 business start-ups in the state. Additionally, the Cabinet Meeting introduced two major categories under this scheme: the Asaan Karobar Card Scheme, which offers loans up to PKR 10 lakh (1 million) interest-free, and the Asaan Karobar Finance Scheme, providing up to PKR 3 crore (30 million) under specific conditions. To further facilitate applicants, the Asaan Business Card and Asaan Karobar Card were also introduced, making loan accessibility smoother and more transparent.

Objectives of the Asaan Karobar Finance Scheme

- The Asaan Karobar Finance Scheme focuses on boosting economic growth and development by supporting small and medium-size entrepreneurs. By offering startup funding, the program helps new entrepreneurs in establishing new businesses while also working on modernizing existing operations and setups.

- Another major goal is to boost exports and create job opportunities, ensuring that the scheme benefits various industries, including agriculture and small and medium enterprises (SMEs). Additionally, the plan includes leasing for commercial logistics, allowing businesses to scale efficiently.

- A unique aspect of this initiative is its emphasis on climate-friendly business practices using Resource Efficient and Cleaner Production (RECP) Technologies. This approach ensures sustainability and long-term economic benefits.

Benefits of Asaan Karobar Finance Scheme

- The scheme provides an interest-free loan of up to 30 Million (3 Crore Pakistani Rupees), making it one of the most accessible financing programs for business owners.

- To further enhance business growth, additional incentives include a Rs. 5 million capital subsidy specifically for solar equipment and production technologies, helping businesses transition to energy-efficient operations.

- Entrepreneurs will also receive non-financial advisory services to support the development of new small industrial states, ensuring long-term economic success.

- The scheme offers long-term leases of up to 30 years, reducing the high costs of land acquisition and making it easier for businesses to secure physical spaces for expansion.

Who Can Apply for the Asaan Karobar Finance Scheme?

The Punjab Government has designed this scheme to support small businesses and individuals looking for startup capital. Whether you are an entrepreneur planning to establish a new venture or expand an existing business, meeting the eligibility criteria is essential to apply. The scheme is structured into two tiers, each with different loan conditions.

General Eligibility Requirements

To apply for the Asaan Karobar Finance Scheme, all applicants must fulfill the following eligibility requirements:

- Be residents of Punjab

- Hold a valid CNIC and NTN

- Be an active tax filer with FBR

- Have a registered mobile SIM under the applicant’s name

- Maintain a clean credit history with no prior loan default

- Own or have a rented place for the business location, supported by proper documentation

Loan Categories Under the Scheme

The loan amount and repayment terms vary based on the category an applicant falls into:

Tier-1: Unsecured Loan for Small Businesses

- Maximum loan limit: PKR 10 lakh

- Repayment period: 3 years

- No collateral required

- Personal guarantees needed for approval

- Designed for small enterprises with annual sales up to PKR 150M

Tier-2: Secured Loan for Expanding Businesses

- Loan amounts range from Rs. 5 million to Rs. 30 million

- Loans above PKR 50 lakh require security or collateral

- Repayment period: 5 years

- Applicable for medium enterprises with annual sales between PKR 150M and PKR 800M

- Must provide proper documentation of business location

Additional Processing Details

Applicants should be aware of processing fees associated with the loan application. The scheme ensures that businesses receive financial support with minimal conditions, making it easier for them to focus on growth and sustainability.

Easy Steps to Apply for the Asaan Karobar Finance Scheme

The Punjab Government has introduced the Assan Karobar Finance program to support aspiring entrepreneurs and startups by offering interest-free funding. To benefit from this loan scheme, applicants must follow a structured application process on the official website. Ensuring accuracy and completeness in your online application form will increase your chances of approval.

Apply Now

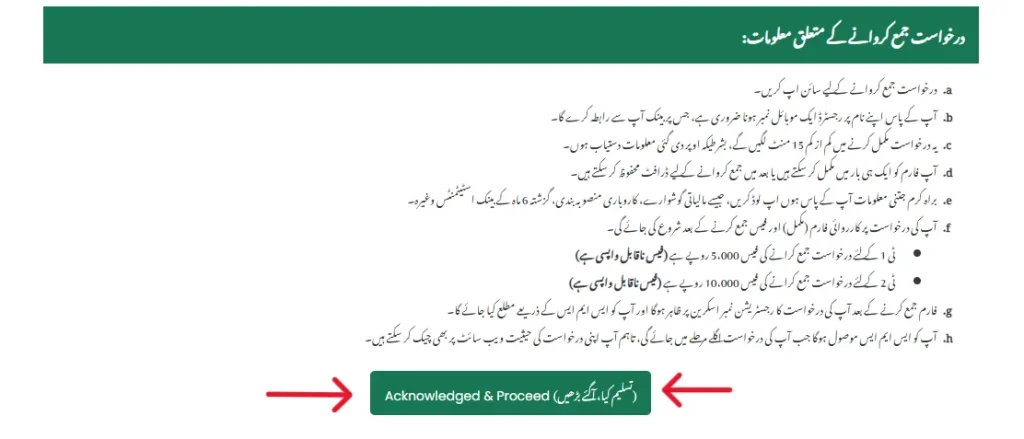

Step 1: Start Your Application

- Click the apply button on the official website.

- Read all instructions carefully to understand the application procedure.

- Click the acknowledge option and proceed to the next step.

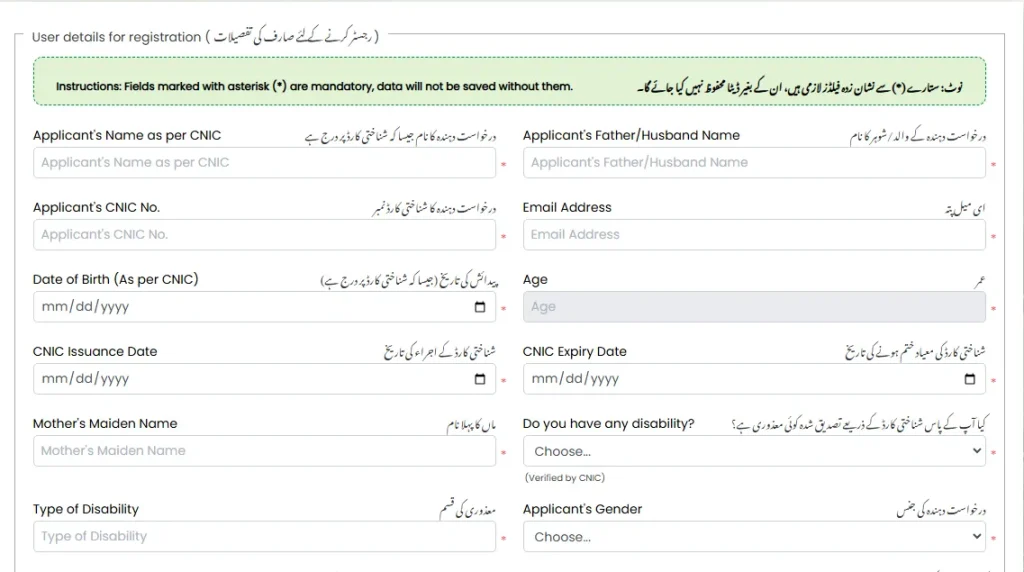

Step 2: Enter Your Profile Information

- Fill in the applicant’s name, father/husband name, CNIC No., email address, DOB, age, and gender.

- If applicable, mention any disability (must be verified by CNIC).

- Enter your mobile number (must be registered in your name) and residential address.

- Provide your NTN number and disclose any political affiliation.

- Create a password, click register, and then login to proceed.

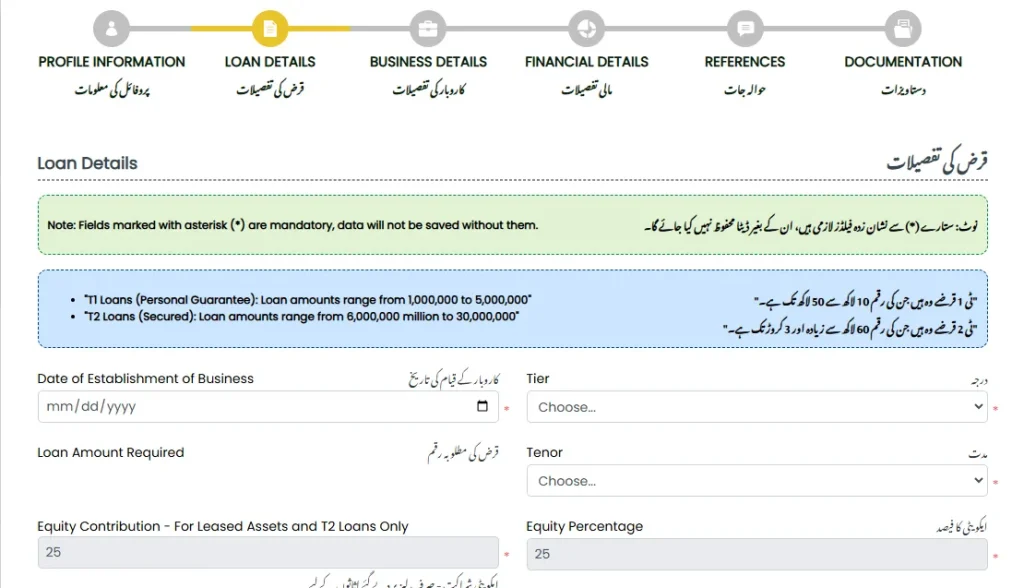

Step 3: Provide Loan Details

- Enter the date of establishment of your business.

- Select the Tier-1 or Tier-2 category based on your required loan amount.

- Specify the tenor of the loan and include any other information related to financing.

- Provide details about your credit history and click save and next.

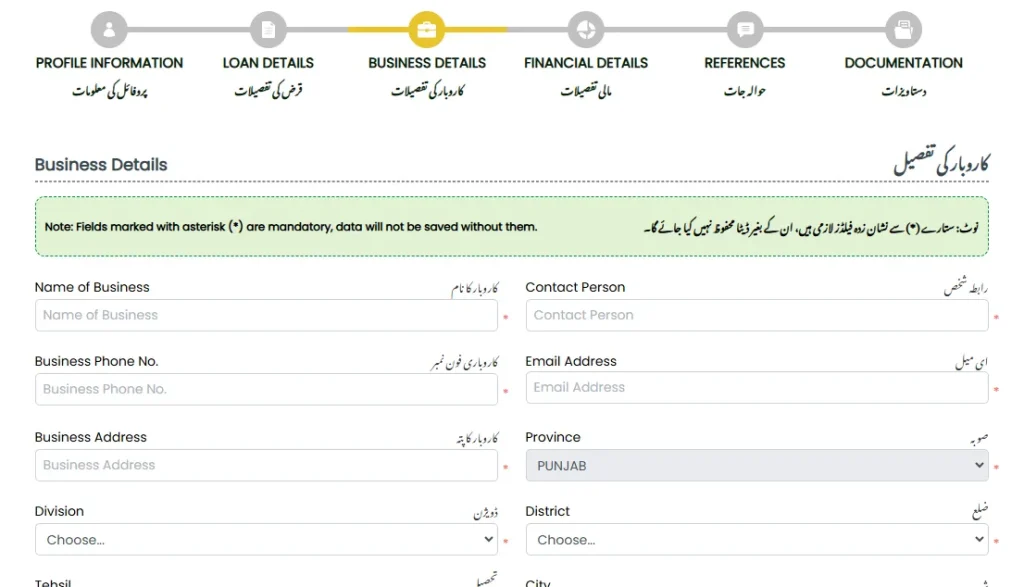

Step 4: Business Information

- Enter the business name, contacts, number of employees, and related information.

- Click save and next to continue the progress of your application.

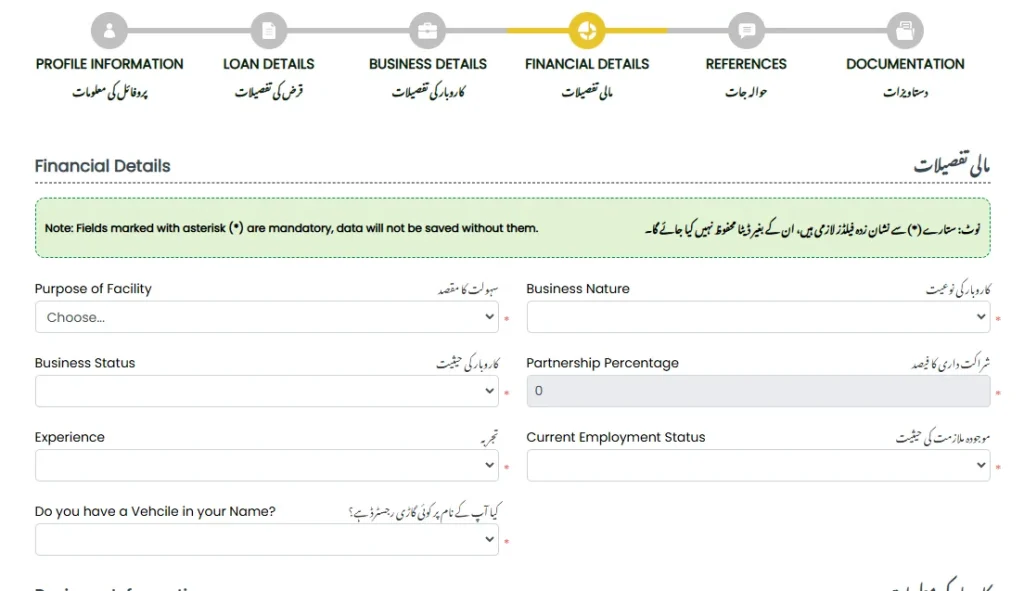

Step 5: Financial Information

- Describe the purpose of your business, its nature, and status.

- Provide any related details and click save and next.

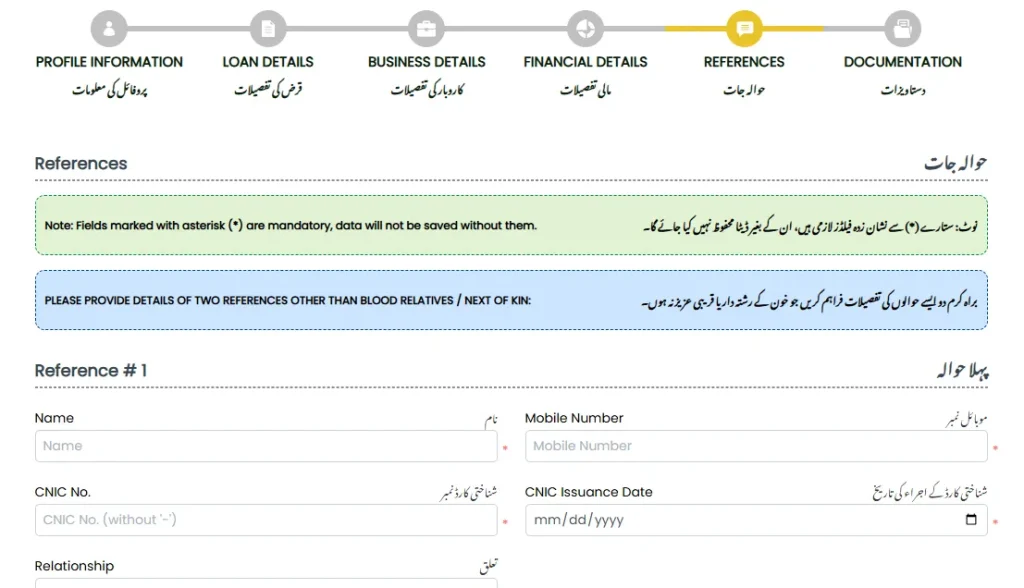

Step 6: References

- Enter details of references who are not blood relatives or next to kin.

- Click save and next to proceed.

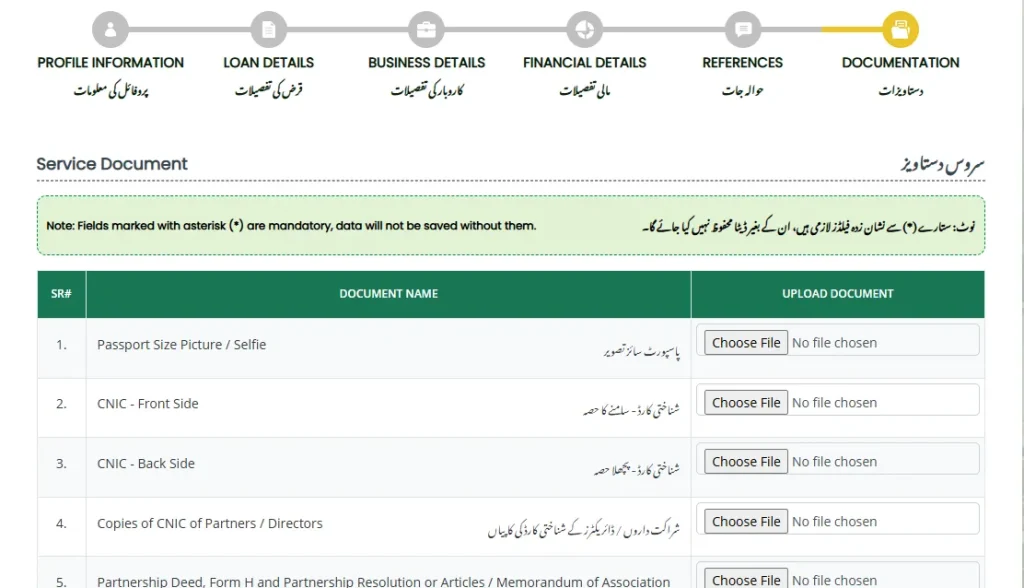

Step 7: Upload Documents and Submit

- Upload all required documents, such as your one-year bank statement, mobile banking statement (Easypaisa/JazzCash), and business details (for established businesses).

- Pay the processing fee to complete the loan application submission.

- Once your application is successfully submitted, a special card will be issued to successful applicants, and the loan funds will be disbursed accordingly.

Important Considerations

- The first PKR 5 lakh must be utilized within six months before additional funds can be disbursed.

- Businesses must complete business registration with FBR or PRA to qualify for further funding.

- Loan repayment begins after six months for startups and after three months for existing businesses.

- This golden opportunity allows entrepreneurs to grow businesses and contribute to economic development.

- For further details, visit the official website of the Punjab Government’s loan scheme.

Understanding Loan Tiers and Repayment Terms

The Government of Punjab has introduced two tiers under the Asaan Karobar Finance Scheme to accommodate businesses of different scales.

- Tier-1 (T1): Offers loans ranging from PKR 1-5 million with a personal guarantee as security. The tenure is up to 5 years, with a 0% end-user rate and a processing fee of 5000 PKR.

- Tier-2 (T2): Provides secured loans between PKR 6-30 million with the same 5-year tenure and 0% end-user rate but requires a processing fee of 10,000 PKR.

A grace period of six months is granted for startups and new businesses, while existing businesses receive three months before repayment begins.

Equity Contribution for Different Loan Types

- 0% contribution is required for T1, except for leased commercial vehicles.

- 25% is required for leased vehicles.

- 20% equity applies to all other loans under T2.

- A special 10% contribution applies to females, transgender, and differently-abled persons.

Additional Costs and Repayment Conditions

- A handling fee is NIL for those setting up a new business.

- 3% per annum applies to existing businesses.

- NIL per annum is offered for climate-friendly businesses under T2.

- Insurance, legal charges, and registration charges are calculated at actual costs.

- Repayments will be made through equal monthly installments as per the terms of approval.

- A late charge of PKR 1 per 1000/day is applicable on overdue amounts.

Future Expansion – Phase II of the Scheme

To further support small and medium enterprises (SMEs), the Government of Punjab plans to launch Phase II of the Asaan Karobar Finance Scheme in fiscal year 2025-26. This phase will have an extended scope of Rs. 100 billion and aims to accommodate 24,000 SMEs, with a total loan disbursement of Rs. 379 billion.

Contact and Support

For assistance, applicants can reach out via the helpline number: 1786.

Asaan Karobar Card for Small Entrepreneurs

The Government of Punjab has also approved the launch of the Asaan Business Card or Asaan Karobar Card. This initiative is designed to facilitate small entrepreneurs by offering interest-free loans of up to Rs. 1 million for three years. To ensure proper utilization, funds will be allocated for business-related activities through digital platforms, with a target of benefiting 100,000 small businesses across the province.

A Vision by CM Punjab Maryam Nawaz

This initiative is part of the reforms package introduced by CM Punjab Maryam Nawaz Sharif to strengthen the economic condition and financial well-being of Punjab. Additionally, it aligns with efforts to enhance housing and agriculture standards, while also promoting renewable energy sectors to create a more sustainable business environment.

Final Thoughts

The Punjab Government’s Asaan Karobar Finance Scheme 2025 is a transformative initiative that empowers small businesses, startups, and entrepreneurs with interest-free loans to strengthen economic growth. With structured loan tiers, flexible repayment options, and special benefits for marginalized groups, this scheme ensures accessibility and financial support for a wide range of business ventures.

By introducing the Asaan Karobar Card, the government is taking a step toward digital financial inclusion, ensuring that funds are allocated transparently and effectively. The planned Phase II expansion further demonstrates a long-term commitment to economic development, especially for SMEs. With the leadership of CM Punjab Maryam Nawaz Sharif, this initiative is set to enhance financial well-being, support agriculture, housing, and promote renewable energy sectors.

For those looking to start or expand their businesses, this golden opportunity provides the resources needed to succeed. Aspiring entrepreneurs can now turn their business ideas into reality by taking advantage of this historic funding opportunity.

Frequently Asked Questions (FAQs)

1. Who is eligible to apply for the Asaan Karobar Finance Scheme?

Applicants must be residents of Punjab, have a valid CNIC, and be an active tax filer with FBR. The scheme is open to small businesses, startups, and entrepreneurs with a registered business location (either owned or rented).

2. What is the loan amount offered under the scheme?

The scheme is divided into two tiers:

- Tier-1 (T1): Offers PKR 1-5 million with a personal guarantee.

- Tier-2 (T2): Offers PKR 6-30 million with secured collateral.

3. Is there any processing fee for applying?

Yes, the processing fee is:

- PKR 5000 for Tier-1 applicants

- PKR 10,000 for Tier-2 applicants

4. What is the repayment period for the loan?

The loan tenure for both T1 and T2 is up to 5 years, with equal monthly installments as per the terms of approval.

5. Is there a grace period for loan repayment?

Yes, the scheme provides:

- 6 months grace period for startups/new businesses

- 3 months grace period for existing businesses

6. What is the equity contribution requirement?

- 0% for T1, except for leased commercial vehicles

- 25% equity for leased vehicles

- 20% equity for other loans under T2

- 10% equity for females, transgender individuals, and differently-abled persons

7. What are the additional costs associated with the loan?

- No handling fee for new businesses

- 3% per annum for existing businesses

- No annual fee for climate-friendly businesses under T2

- Insurance, legal, and registration charges apply as per actual costs

8. How will the loan be disbursed?

Approved applicants will receive a special card through which the loan funds will be disbursed digitally. The first PKR 5 lakh must be utilized within 6 months, and further funds will be released based on business registration with FBR or PRA.

9. How can I apply for the Asaan Karobar Finance Scheme?

Applicants must:

- Visit the official website of the Punjab Government’s loan scheme

- Fill out the online application form

- Upload required documents, including CNIC, bank statements, and business details

- Submit the application and wait for approval

10. Is there a helpline for inquiries?

Yes, applicants can contact the Punjab Government’s official helpline at 1786 for further details and assistance.

11. What is the Asaan Karobar Card, and how does it work?

The Asaan Karobar Card (also known as Asaan Business Card) is designed to facilitate small entrepreneurs by providing interest-free loans up to Rs. 1 million for three years. The funds will be digitally allocated to ensure proper business-related usage, benefiting over 100,000 small businesses across Punjab.

12. What is Phase II of the Asaan Karobar Finance Scheme?

The Punjab Government is planning to launch Phase II in the fiscal year 2025-26, expanding the scheme to Rs. 100 billion, aiming to accommodate 24,000 SMEs with a total loan disbursement of Rs. 379 billion.